Lauma

investors’ page

What are the advantages

of the European market

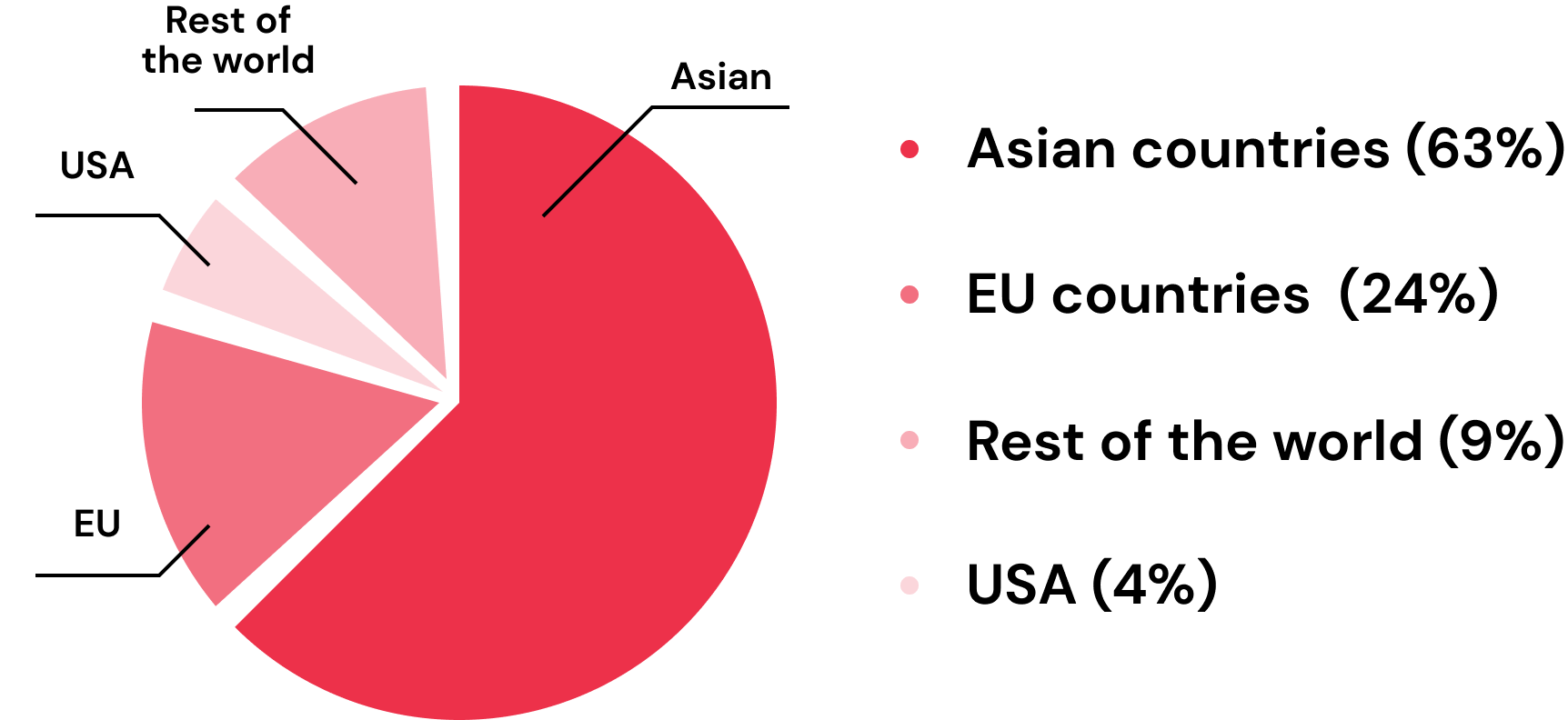

(63%). Europe is in second place with 24%.

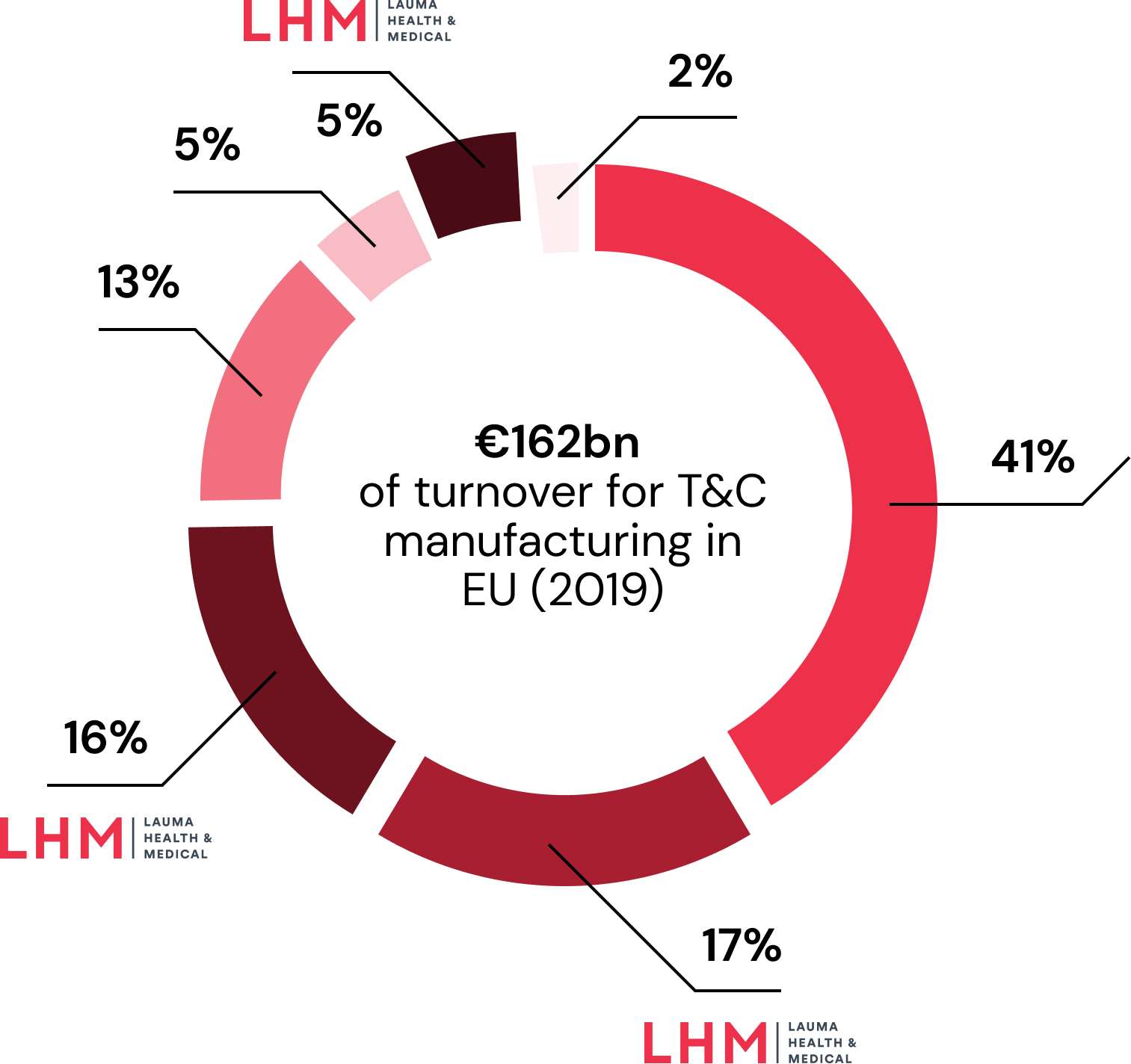

Textiles bring European manufacturers about 66 billion euros annually. And LHM is among the leaders.

That is because 3 main factors determine the current market:

- Environmental, Social, and Corporate Governance, ESG;

- The necessity of producing small and medium-sized batches;

- The growing demand for high-tech products requires laboratories for research and testing.

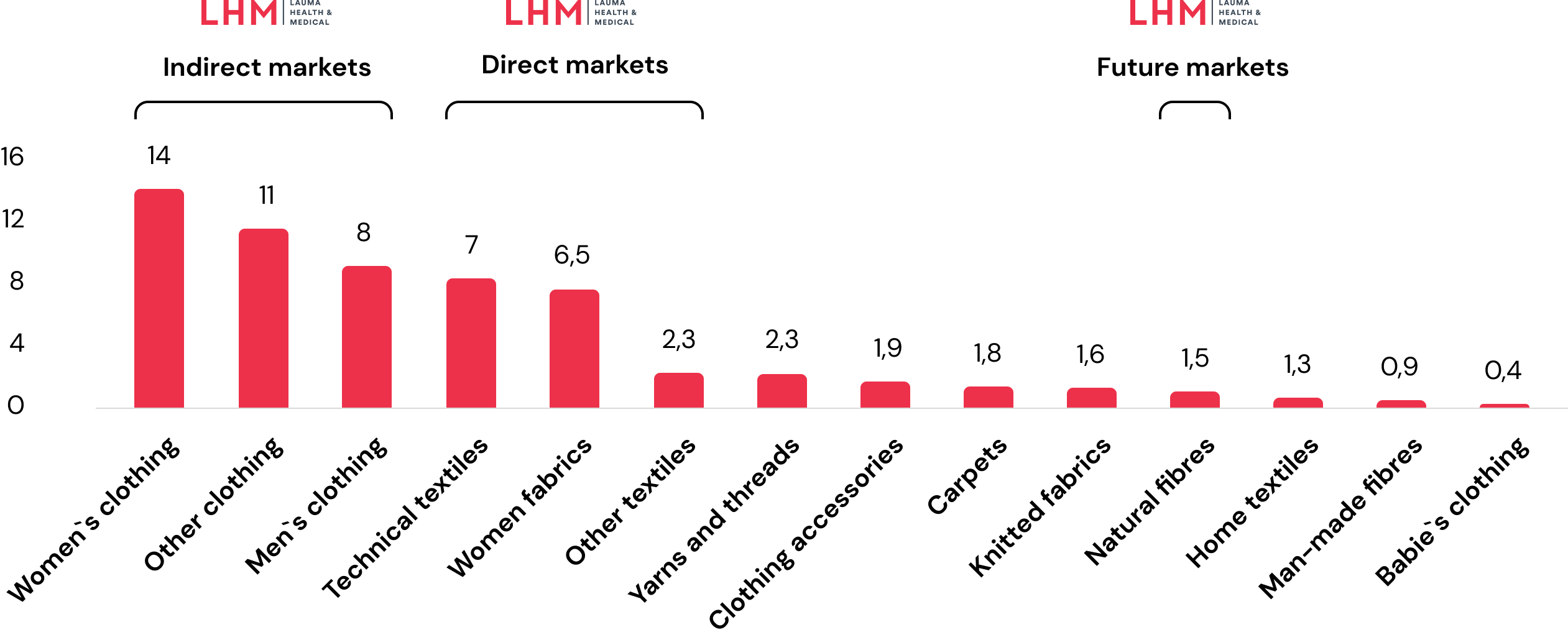

Exports by product categories (2019) in €Bn

The trends mean that manufacturers with solid areas of expertise are capturing a significant share of the market.

And business goes into specialization, into niche areas, rather than diversification of the products produced. At LHM these are woven, nonwoven, and medical textiles.

The EU market is highly fragmented with approximately 53,000 textile companies (11% of which are SMEs) in 2019. Lauma Health and Medical accounts for 27.5 billion in product revenues in the EU alone with a corporate structure of 3 production facilities (Latvia, Lithuania, and Germany).

Segmentation of the European textile market with LHM positioning

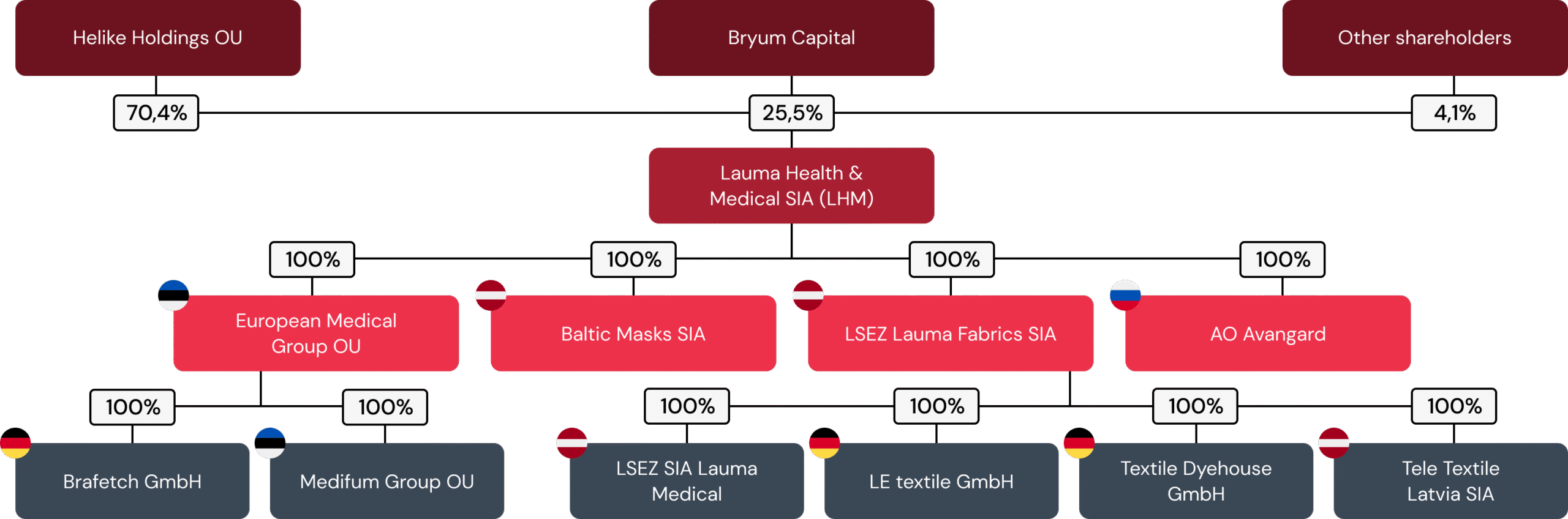

Corporate Structure at 2021

The company developed from a single factory, Lauma Fabrics, which we turned into a solid foundation for other companies.

It is now not only Europe’s No. 1 textile manufacturer but also a Spin-off laboratory.

By allocating resources from the main company, we develop partner companies. They become independent facilities and adjust to market trends. The ultimate cost of such a company is higher than it would be as part of a single enterprise.

The growth strategy for the coming years is based on the company’s ability to offer unique and customized solutions to its customers, using its innovative capabilities and its way of spin-off companies from the Spin-off lab.

This strategy will allow LHM to become a plug-and-play platform that consolidates the market and strengthens the value chain.

Lauma doesn’t follow trends.

It creates them

Current certifications owned by LHM

Examples of certifications targeted by the group

ESG is a fundamental trend without which a player in the textile market cannot exist:

- 57% of consumers are willing to give up harmful products in favor of eco-friendly materials;

- An increasing number of regulations and initiatives (e.g. REACH, COP26, and others) by European governments

LHM is 100% insourcing and employs local workers. The company takes care of the environment by using biodegradable materials and renewable energy sources (water and solar). And the products are Oeko-Tex certified.

In the future, we plan to cover all 100,000 square meters of production area for solar panels. This is another trump card to the trend of going green and getting rid of spending on other energy sources.

The attractiveness of the European market for textile production

- High demand for sophisticated and sustainable textile solutions (e.g. 12.1% annual growth in natural fibers since 2009), produced by expert players from the U.S. and Europe.

- International players are locating their production in Europe because it is a site with low business risks.

- + 53,000 new players in the EU textile market, of which 11% are small and medium-sized companies.

50 years

Dynamic growth of the nonwoven textile market

New needs in the healthcare niche are a motivator for the textile industry boom. Lauma Medical produces compression products, elastic medical bandages, elastic waistbands, elastic braces, and maternity/lactation underwear. Thereby significantly closing the demand in the medical textile market.

1.4 million metric tons of nonwovens are imported annually. Germany, Poland, and Italy dominate the nonwovens market (41% of volume). One of LHM’s factories is in Germany, reinforcing the holding company’s capacity.

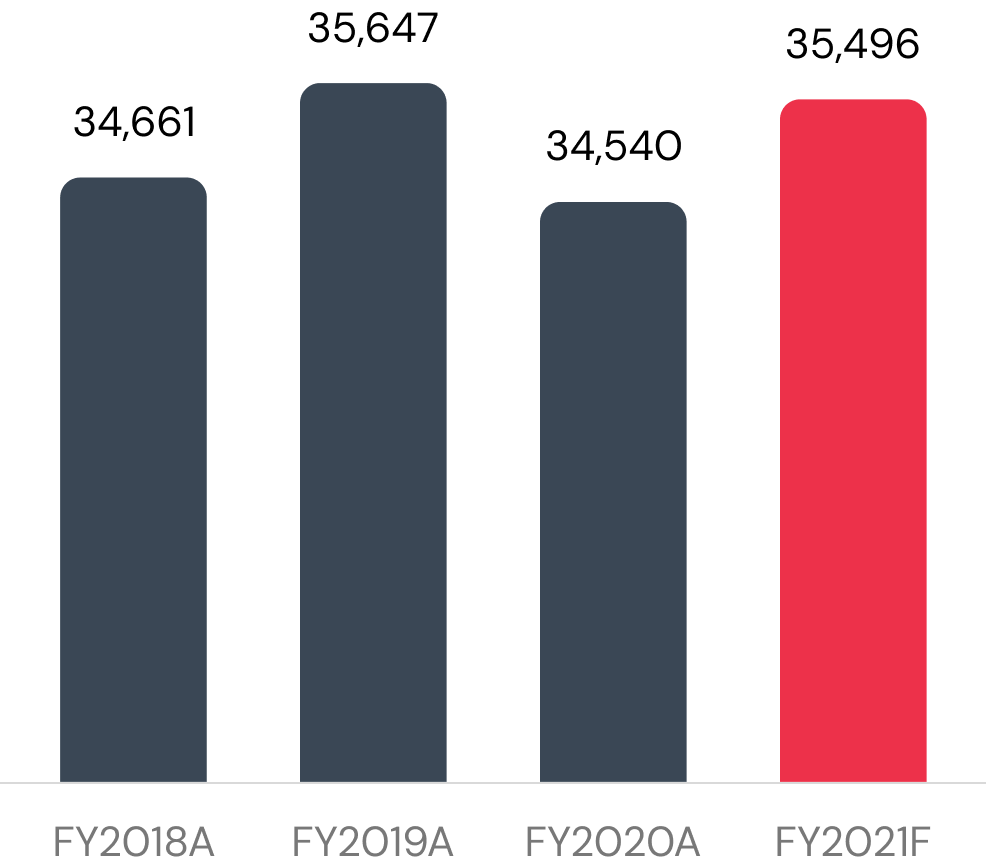

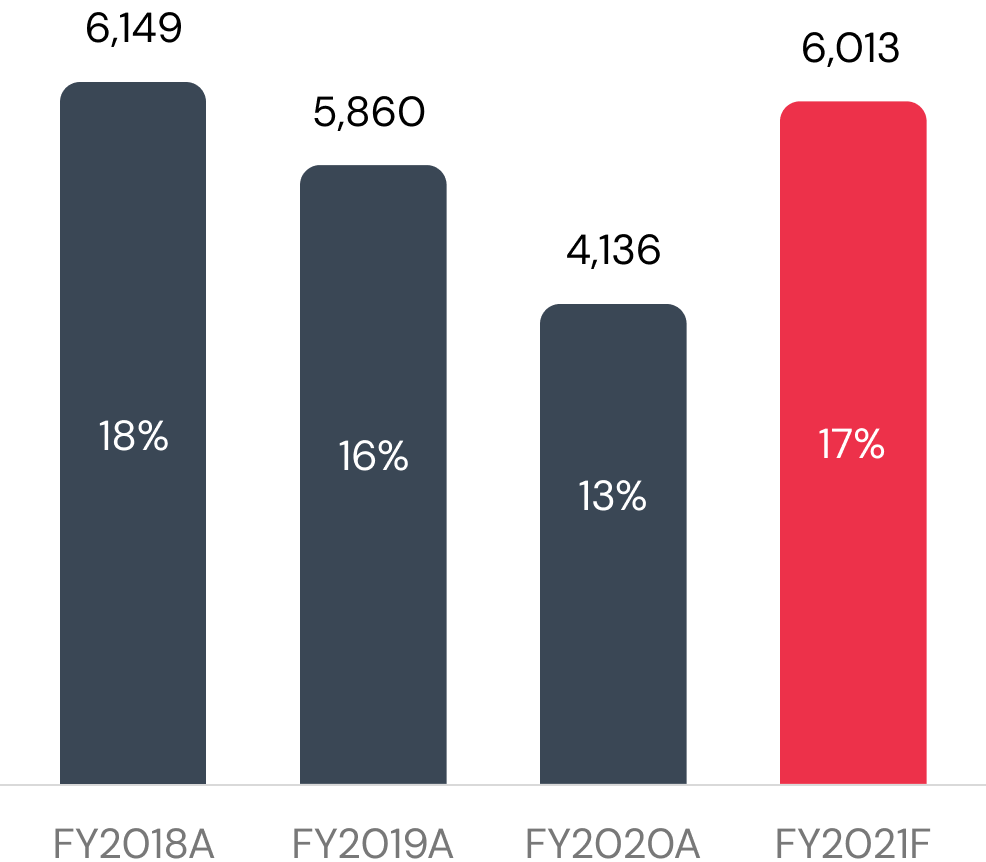

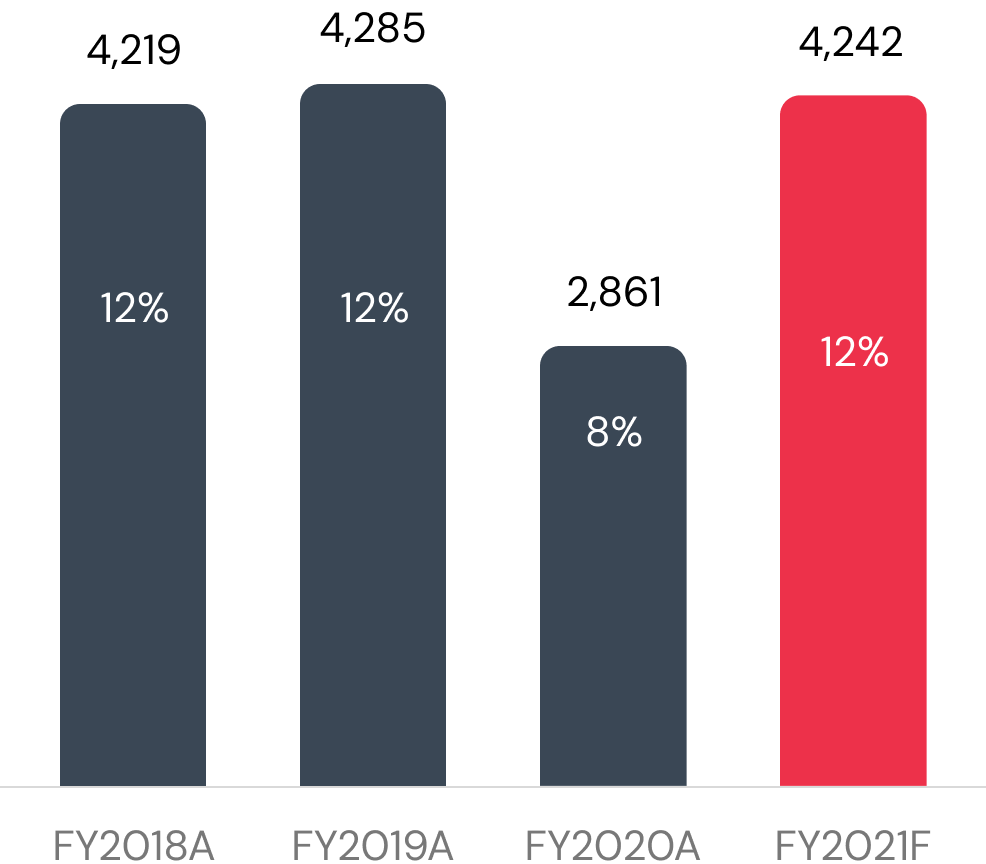

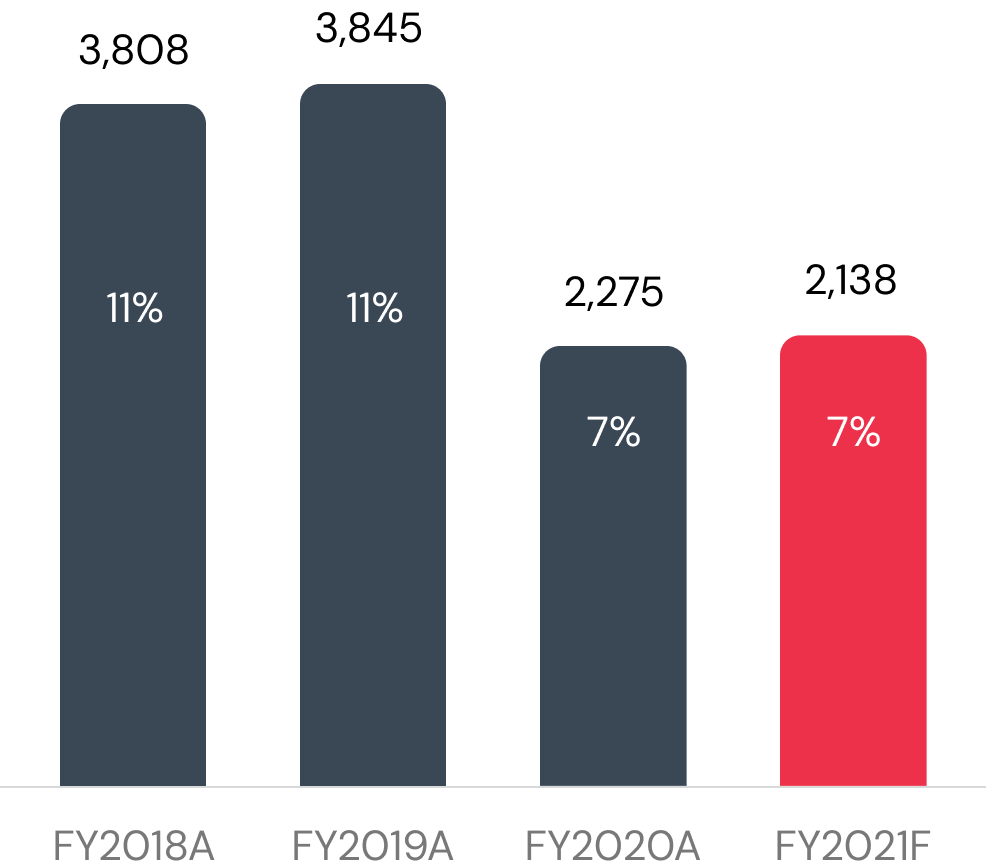

The company's financial results

are a clear proof of that

Key reasons for investing

We have been laying down trends in the

industry since 1969.

facilities, the company produces more than 50 million meters of materials annually.

We plan to become a consolidated European platform.

and a planned IPO in 2023-24 are proof of that.

The company is in the hands of experienced corporate players

In 2021, LHM strengthened itself by hiring a highly qualified CEO. Management has extensive management experience in large corporations, entrepreneurship, and creating value businesses for safe investing.

Performance is supported by the company’s financial reports and accurate analysis of the future of the market.

Selected experience:

- LHM: Group CEO (since 2019)

- Lauma Fabrics: Chaiman (since 2004)

- Sycamore investments (PE fund)

- Managing Partner (since 2013)

Education:

Stolckholm School of Economics